Controllers Council recently held a webinar on the 2023 Controller CFO Sentiment Study Results Preview and Panel Discussion, sponsored by Sage Intacct.

Our speakers were Mark Floisand and Chad Wagner. Mark is EVP Global Product Marketing for Sage with 25 years of experience, including Coveo, Adobe, Apple BusinessObjects, SAP, and more. Mark’s education includes Stanford Graduate School of Business, London Business School, and is based in San Jose, California. Mark was born in the UK and grew up in South Africa. Chad Wagner is senior industry marketing strategist for Sage Intacct and his career experience includes DXC technology, Tata Consulting, HP and Dell. Chad earned a Bachelor of Science in journalism from Ball State University and is based in Austin, Texas.

During this discussion, Mark and Chad discussed several key predictions for changes in financial metrics, spending, talent and more in 2023. If you are interested in learning more, view the full webinar archive video here.

Predictions 1: Increased Financial Metrics predicted for Revenue by 61%, Profits by 48% and Gross Margin by 41%

Revenue is in position one, which is not a surprise because revenue top line growth is so important to everyone, but we see that glaring increase of 61% expect revenue to be higher, followed by 48% for profits, which is in the number four position from a weighted average standpoint. Again, these weighted averages are very close to each other, so it doesn’t really mean that much because they’re so close, but so profits.

“I think it correlates with some of the observations we’ve just made about the optimism that exists in the smaller end of our economy, and that’s reflected in that revenue number. What’s the most important financial metric? Increasing revenue. Growth drives everything. If you are growing, if you’re able to invest in growth, most other things follow.”

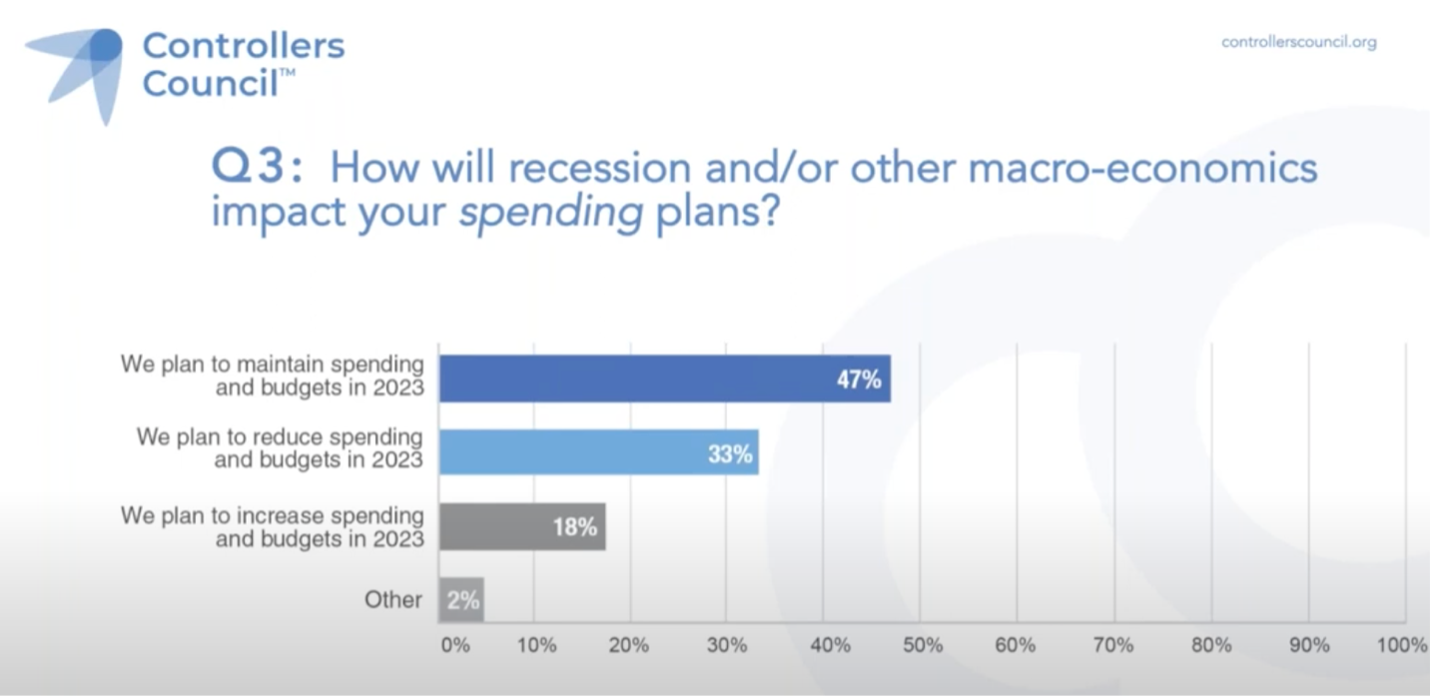

Prediction 2: Reduced Spending and Budgets are anticipated for 33%

How will recession and/or other macroeconomics impact your spending plans? This tells us that reduced spending and budgets are anticipated for 33% with only 18% increasing spend and 47% staying the same. This is again, one of our two new indexes. This is the 2023 controller CFO spending budget index of 85%.

We calculate increase spend minus reduced spend, and you calculate that to planning on spending 85% of the 100 base in 2023. Again, that goes along with that other index of 127% increase in financial performance along with only 85% of the spend. Again, this is some interesting ways to look at this.

“I’ll just say that this is a time where the innovators, the flexible SMBs take charge and figure out how to be more productive. Then, they come out of this uncertainty this time of economic uncertainty, which it still is, I believe, stronger. Then, they can gain more market share by the work they’re doing now to manage costs and to get more out of their technology.”

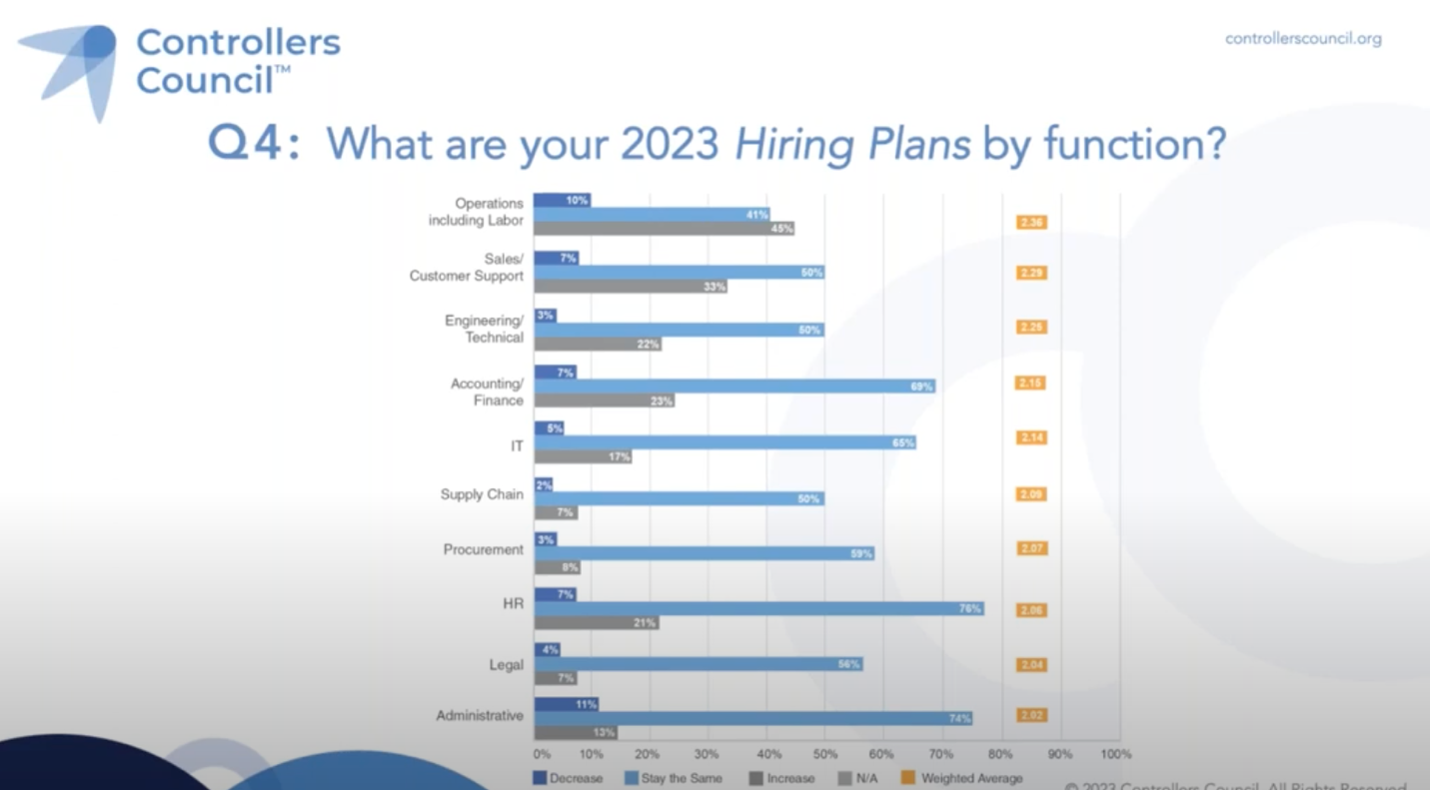

Prediction 3: Hiring plans are highest for Operations, followed by Sales/Customer Support, Accounting Finance and Engineering/Technical

Operations leading all with 45% seen an increase followed by sales and customer support, accounting and finance third in increased hiring. Then, followed by engineering, technical hiring low for supply chain, legal procurement, administrative IT and HR as mentioned. We’ve got the weighted average here, which is how they’re presented from highest to lowest, but on a three-point scale, very, very close on this. We see some glaring things like administrative and HR staying the same more than anywhere else that’s followed by accounting finance.

“What strikes me is that the hiring is taking place in the physical. It’s the primary and tertiary, if you are an operations’ organization making stuff, you need people touching machines. You need people physically packing boxes, moving stuff into the back of a van. Much as we see all the social media about the prowess of Boston Scientific back flip robots, they’re not everywhere yet. There is this need for people to move things as part of the business of being a secondary or a primary industry. That’s what leap out me on the top one, that sense of there is rising labor costs as organizations looking to grow. We’re seeing a manufacturing rejuvenation here in the US. I think this speaks to it. There aren’t enough people touching stuff in the supply chain, and that’s very much echoed there.”

Prediction 4: Concerns – Interest Rates, Geopolitical Risk, Inflation, Talent, and Recession

“We’ve seen the relatively good news of interest rates are going to go up, but they’re going to go up less often and they’re going to go up by smaller amounts, which is a signal from the Fed about their future expectations of what’s going to happen with inflation.

Of course, these things are interrelated, they’re intertwined. However, when I look at this chart, what also strikes me is that the top four geopolitical risk, interest rates, inflation, recession, none of us can do anything about. Why lose sleep over it? Of course, mitigate plan, what are you going to do in the event of, but you can’t change those, but you can control the two at the bottom.”

To view the complete webcast panel discussion, click here.

To download/read/print the 2023 Controller/CFO Sentiment Study Results Report, click here.

ABOUT THE SPONSOR:

Sage Intacct gives leaders of digital-savvy, intelligent organizations the visibility and agility to make the right data-driven decisions at the right time to steer their organizations and people to growth and recovery. As the innovation and customer satisfaction leader with over 20 years of experience as a native cloud financial management system, Sage Intacct is the only solution to earn the top score in Gartner’s Cloud Core Financial Management Suites Lower Midsize Enterprise Use Case for 4 years in a row, is the first and only preferred provider of the AICPA and is ranked #1 in customer satisfaction by G2. Tightly integrated with budgeting and planning and paired with HR and people software, Sage Intacct enables digital transformation through continuous accounting, continuous trust, and continuous insight.