Are you an accounting wizard? Maybe, maybe not. Regardless, your math needs to add up. And sometimes, even the greatest mathematicians make mistakes. If you make an accounting error, you must find it—before it harms your business. That’s where a trial balance comes in.

An accounting trial balance is for businesses that use accrual accounting. In accrual accounting, your debits and credits must equal one another. If they don’t, there’s an error in your books. The trial balance helps you discover and get to the root of mistakes in your double-entry accounting books.

What is trial balance?

A trial balance is an accounting report that lists your small business general ledger account balances in two columns: debits and credits. The report shows you whether your debits and credits equal one another at a point in time. If the trial balance shows that your debits and credits don’t equal, you need to find ways to balance the accounts.

Unequal debits and credits may be the result of errors like:

- Errors of omission: Forgetting to record an accounting entry in your books

- Transposition errors: Reversing the order of two or more numbers when recording a transaction (e.g., 21 vs. 12)

- Reversing entries: Switching the account to be debited and the account to be credited

Don’t panic if your debits don’t match your credits. The purpose of trial balance is to find errors and fix them so your accounting books are accurate.

Preparing a trial balance is an integral part of the accounting cycle and closing your books. You should prepare trial balance reports at the end of each reporting period. That way, your books are accurate and updated (which could save you from audits and penalties).

Why is a trial balance important?

Businesses need accurate books to prepare financial statements. And you need financial statements to make data-based decisions in your business, secure funding, and more. Talk about a chain reaction!

So, how do you determine whether your books are in balance? A trial balance verifies your accounting books are accurate and error-free.

If you don’t use a trial balance, you risk preparing financial statements with potentially inaccurate data.

Types of trial balance

Business owners prepare a trial balance more than once during the accounting cycle. In fact, you need to use three trial balances when closing your books—one for three different stages in the cycle. That way, your debits and credits always balance.

There are three types of trial balances you should know about:

- Unadjusted trial balance: This shows you your general ledger account balances before you complete adjusting entries.

- Adjusted trial balance: This shows you the final balances in your general ledger accounts after you complete adjusting entries.

- Post-closing trial balance: This shows your account balances after you finish closing temporary accounts.

What does a trial balance include?

A trial balance is formatted similarly to your general ledger. There are typically three columns:

- Accounts

- Debits

- Credits

You should have asset, expense, liability, equity, and income accounts. Examples of account names include “Cash,” “Accounts Receivable,” “Accounts Payable,” and “Revenue.”

The trial balance does not list each transaction your business made under the accounts. Instead, it shows each account’s total debit and credit balances.

Trial balance vs. general ledger

The trial balance and general ledger are very similar. Both typically have three columns: accounts, debits, and credits. However, your general ledger is more detailed than a trial balance.

General ledgers show detail transactions for every account. Trial balances only show each account’s debit and credit balances.

Who uses a trial balance for small business?

Businesses, accountants, and bookkeepers all use trial balances to make sure a company’s books are accurate.

When do businesses prepare trial balances?

Again, prepare trial balances when closing your books for a period (e.g., a month). Typically, the trial balance is the first step of the closing process.

You’ll likely prepare an unadjusted, adjusted, and post-closing trial balance during the accounting cycle.

How to prepare a trial balance

So, you know what a trial balance is and why it matters. Now, it’s time to learn how to prepare one.

1. Gather general ledger information

To create a trial balance, you need your general ledger information. Grab your accounts, debits, and credits. You do not need each detailed transaction.

2. Put together your trial balance worksheet

Separate your debits and credits by account. You should have three columns: accounts, debits, and credits.

Once you set up the format, look at your general ledger entries. Take the information from your general ledger and enter it into your trial balance worksheet.

List each account and the debit and credit amount.

After you enter all your information into the, find the debit total by adding up all the amounts in the debit column. Then, find the total for the credit account.

3. Compare your debit and credit balances

Now, it’s time to compare your debits and credits in accounting.

If the two numbers match, you have a balanced trial balance. If the two numbers are unequal, you have an unbalanced trial balance.

In double-entry accounting, your debits must equal your credits. Find out why the totals don’t equal and adjust your entries.

Trial balance examples

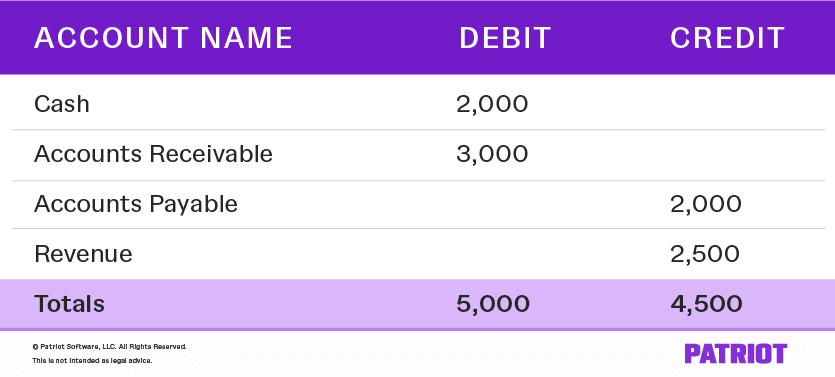

Take a look at examples to help you learn trial balance accounting. Here is an example of how to format your trial balance:

Now, you need to learn how to read a trial balance. Compare the total values to determine whether your balances are equal. As you can see, the debits equal the credits. This means you don’t need to adjust anything with your trial balance.

Sometimes, your debits and credits will be unequal. If there is a mistake, you will have a trial balance report showing different debit and credit balances:

There is a discrepancy of $500 between the debits and credits. You need to refer back to your general ledger to determine where the error is. Start by looking at your accounts receivable and inventory entries.

Let’s say you have three relevant entries:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 12/1 | Accounts Receivable | 1,000 | |

| Revenue | 500 |

| Date | Account | Debit | Credit |

|---|---|---|---|

| 12/7 | Accounts Receivable | 1,000 | |

| Revenue | 1,000 |

| Date | Account | Debit | Credit |

|---|---|---|---|

| 12/14 | Accounts Receivable | 1,000 | |

| Revenue | 500 |

The first entry, created on 12/1, is unbalanced. You debited $1,000 but only credited $500 worth of revenue. This is the $500 discrepancy. Now that you know where the error is, you can adjust the entry so it looks like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 12/14 | Accounts Receivable | 1,000 | |

| Revenue | 1,000 |

Finally, you’re ready to roll. You can adjust your general ledger with the new value.

Keeping accurate books and catching mistakes on your own can be time-consuming. Instead, try Patriot Software’s accounting software for small business. Maintain accurate records, prepare a trial balance, and create financial statements. Try it for free today!

This article has been updated from its original publication date of November 3, 2017.

This is not intended as legal advice; for more information, please click here.