A number of states have hopped on the paid sick leave bandwagon. One of the newest states to do so is Colorado. In addition to regular sick leave, the state also offers public health emergency leave for time off due to COVID. Learn the ins and outs of the Colorado paid sick leave law, including how it works and accrual rates.

Paid sick leave overview

So, what exactly is paid sick leave? Paid sick leave is time off an employee can take if they or a family member is sick.

The states with paid sick leave determine what qualifies for time off. This typically includes time off for physical or mental illness, injury, preventative care, and other health conditions. Some states may even let employees use paid sick leave for services after domestic violence, stalking, etc.

Paid sick leave laws vary by state. However, the laws typically include rules for which employers need to follow the law, what employees can use time off for, accrued time off rates, and maximum accrual limits.

Colorado paid sick leave: FAQs

If you’re an employer in Colorado, you need to know all about accrued paid sick leave to stay compliant. Get to know everything about the law by checking out some frequently asked questions below.

What is it?

The Colorado Healthy Families and Workplaces Act (HFWA) requires Colorado employers to provide paid sick leave to qualified employees. Currently, this includes two types of paid sick leave:

- Accrued leave

- Public health emergency (PHE) leave

The accrued leave is Colorado’s “regular” paid sick leave for employees. Employees can only receive PHE leave for COVID-related reasons, and this part of the law is temporary.

For both types of leave, employers must pay employees at the same pay rate the employee would earn if they were working. And, employers can’t count an employee’s sick leave as absences.

What does PHE leave include?

Again, PHE leave is a temporary part of the Healthy Families and Workplaces Act Colorado. PHE leave is ongoing as long as a federal or state public health emergency is declared. This part of the law will be in effect at least until May 2023.

All employers in Colorado, regardless of industry or size, must provide PHE leave to employees if they experience the following:

- Having symptoms of COVID, such as fever or chills, cough, fatigue, muscle or body aches, headache, sore throat, and congestion or runny nose

- Quarantining or isolating due to exposure to COVID

- Testing for COVID

- Receiving the COVID vaccination and experiencing side effects

- Not being able to work due to health conditions that may increase susceptibility or risk of COVID

- Needing to care for family (illness, school closure, etc.)

For Colorado public health emergency leave, employers must provide up to two weeks, or 80 hours, of time off to qualifying employees. Part-time employees can receive partial leave, too.

Employers can’t require employers to show documentation for PHE leave.

How much Colorado sick leave can an employee accrue?

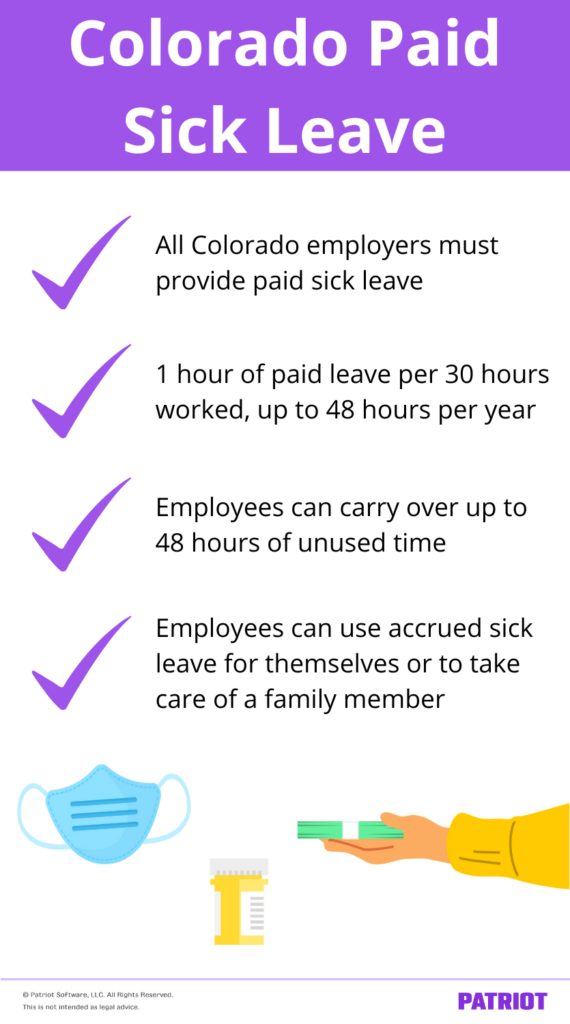

Under Colorado’s sick leave law, employers must provide one hour of paid leave per 30 hours worked, up to 48 hours per year.

Employers can offer a more generous paid sick leave policy (e.g., 1.5 hours for every 30 worked). But, they must at least follow the state’s minimum requirement.

What can accrued leave be used for?

Employees can use accrued sick leave for themselves or to take care of a family member for a variety of reasons. These include:

- Any mental or physical illness, injury, or health condition that prevents work

- Diagnosis, care, or treatment of health conditions

- Preventive care

- Vaccinations

- Needs due to suffering domestic violence, sexual abuse, or criminal harassment

A family member is an immediate family member who is related by blood, marriage, civil union, or adoption. Family members also include a child or person the employee stood in loco parentis for and any person the employee provides health- or safety-related care for.

Which employers does the law apply to?

All Colorado employers must follow the Colorado paid sick leave law.

As of January 2022, small and large employers have the same accrued leave responsibilities. Before 2022, certain employers were exempt from the paid sick leave law.

Can employees carry over accrued sick leave?

Employees can carry over up to 48 hours of unused paid sick leave to the next year.

Do PTO policies and CBAs count for sick leave?

Paid leave in paid time off (PTO) policies or collective bargaining agreements (CBAs) can satisfy HFWA requirements. However, the policy or agreement must cover all the same conditions or needs and be the same pay rate.

Can employers require documentation?

Employers can require employees to provide documentation for accrued paid sick leave for absences of four or more consecutive days. Employees who must provide documentation can provide it after the leave ends.

Where can you find additional information?

For more information, check out the following resources:

Colorado sick leave law: Fast facts

As a Colorado employer, you need to stay compliant with the Colorado HFWA. To help stay on top of your paid sick leave responsibilities, check out these fast facts:

- Colorado offers two types of paid sick leave: accrued and PHE leave

- Employees can only use PHE leave for COVID-related reasons

- All Colorado employers must follow paid sick leave laws, regardless of size or industry

- Employers must provide one hour of paid leave per 30 hours worked, up to 48 hours per year

- Employees can carry over up to 48 hours of unused accrued paid sick leave to the next year

- Employees can use accrued sick leave for themselves or to take care of a family member

- Qualified reasons for paid sick leave include mental or physical illnesses, injuries, and health conditions that prevent work; preventative care; vaccinations; diagnosis, care, or treatment of health conditions; and treatments related to domestic violence, sexual abuse, or criminal harassment

Need an easy way to keep track of employee wages, accrued time off, payroll taxes, and more? Patriot’s online payroll makes paying employees a breeze. And, our expert (and free) USA-based support is there to help you every step of the way. Try it for free today!

This is not intended as legal advice; for more information, please click here.